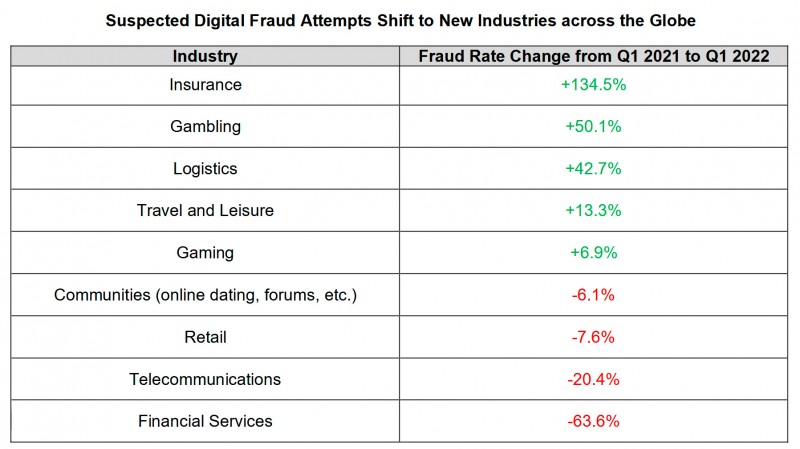

TransUnion’s quarterly digital fraud analysis issued Thursday found the suspected fraud rate year-over-year significantly increased in gambling, insurance and logistics, while it declined in industries such as financial services, telecommunications and retail.

Gambling’s fraud rate grew 50.1% in the first quarter of 2022 as compared to the same period of the prior year. Gaming —which in this study encompasses video games and online role-playing— saw a 6.9% increase in this area.

The global digital fraud rate decreased in Q1 2022 with suspected online fraud attempts declining 22.6% from the same quarter last year.

“Sophisticated fraudsters pressure test which industries have ramped up fraud prevention measures and as a result, turn to new industries if efforts are being thwarted. That’s exactly what we have observed recently as fraudsters look for new opportunities or points of vulnerability,” said Shai Cohen, senior vice president of global fraud solutions at TransUnion. “It is paramount that during this dip companies focus on optimizing the customer experience for good customers.”

The overall rate of suspected fraud originating from the U.S. decreased -23.1% from Q1 2021 to Q1 2022 across all industries. The gaming industry saw the second largest increase in the rate of suspected digital fraud in Q1 2022, growing 27.2% YoY. The financial services industry saw the largest YoY decrease in the suspected digital fraud attempt rate at -56.6%.

“As fraud rates stabilize during a period when fraudsters are searching for new vulnerabilities, many organizations have shifted their focus to identifying more of the good customers and transactions to increase revenue and customer lifetime value. By reducing false positives, false declines, and manual review rates, organizations can dramatically improve the customer experience through trusted connections while still keeping the fraudsters at bay,” said Sean Donnelly, senior vice president and go-to-market global fraud solutions at TransUnion.

TransUnion came to its conclusions about fraud against businesses based on intelligence from billions of transactions and more than 40,000 websites and apps contained in its flagship identity proofing, risk-based authentication and fraud analytics solution suite – TransUnion TruValidate. The percent or rate of suspected digital fraud attempts are those that TruValidate customers either denied or reviewed due to fraudulent indicators compared to all transactions that were assessed for fraud.