The race for the acquisition of PointsBet’s U.S. business has officially concluded, with shareholders having voted in favor of a proposed sale to Fanatics. The vote took place at an extraordinary general meeting late Thursday, with 99.16% of voters approving the sale and 0.84% voting against it. Shareholder approval will allow the sale process to move to the next stage. However, neither of the parties has set a completion date for the deal yet.

A Fanatics spokesperson said in a statement: “We are thrilled that the shareholders of PointsBet Holdings Inc. voted to approve our acquisition of the U.S. businesses of PointsBet. This is a pivotal moment for Fanatics Betting and Gaming that will accelerate our growth in the legal online sports betting, advance deposit wagering, and iGaming markets in the United States.”

“Pending regulatory approvals in the various states in which PointsBet operates, we will have more details to share in the coming weeks on how the acquisition of PointsBet US businesses will bring to life our unique vision for Fanatics,” the statement read.

Ahead of the vote, in a statement released on Tuesday evening, the PointsBet board approved the sale agreement and “unanimously recommended” shareholders also vote in favor of the proposition.

Earlier this week, Fanatics presented a revised offer of $225 million, an increase from their original proposal. The proposal came after Fanatics had initially reached a deal with PointsBet for approximately $150 million, only to be outbid by DraftKings’ $195 million proposal. However, upon confirmation of Fanatics’ improved offer, DraftKings announced that it would no longer pursue a deal to acquire PointsBet US.

Brett Paton, PointsBet Chairman

Prior to today’s vote, Brett Paton, PointsBet’s Chairman, addressed shareholders regarding the reason behind the decision to sell the US business. Paton explained that although PointsBet had achieved strategic accomplishments in the US market, the expenses associated with competing against well-established brands would prevent the business from generating positive cash flow in the near future.

“Continuing to operate the US business would require significant capital and further capital raises,” he said. “This transaction addresses that uncertainty.” According to Paton, while FanDuel and DraftKings have proved successful and together hold around 80% of the U.S. sports betting market, most of the largest established brands have struggled to keep up the pace with the duopoly formed by the two operators.

Out of about 60 online sports betting companies in the US, only seven, including PointsBet, have gained a market share of 1% or more. The executive noted that one of the brands spent $2.5 billion on its digital gaming brand but has achieved only a mid-single digit market share, while also other big-spending online operators have gained less traction and many others have closed.

According to the executive, PointsBet would maintain a presence in North America, even after the proposed sale. The agreement ensures that PointsBet will keep its Canadian and Australian businesses intact. Furthermore, PointsBet will retain full ownership of its exclusive sports wagering and iGaming platform, which is currently utilized in both the Australian and North American markets.

From the conclusion of Friday’s shareholders’ meeting until the transaction is finalized, PointsBet’s funding needs for the U.S. business will be limited to around $21 million. It was also announced that the remaining portion of PointsBet’s $250 million advertising commitment to NBCUniversal, as part of their 2020 agreement with the broadcasting company, will be taken over by Fanatics.

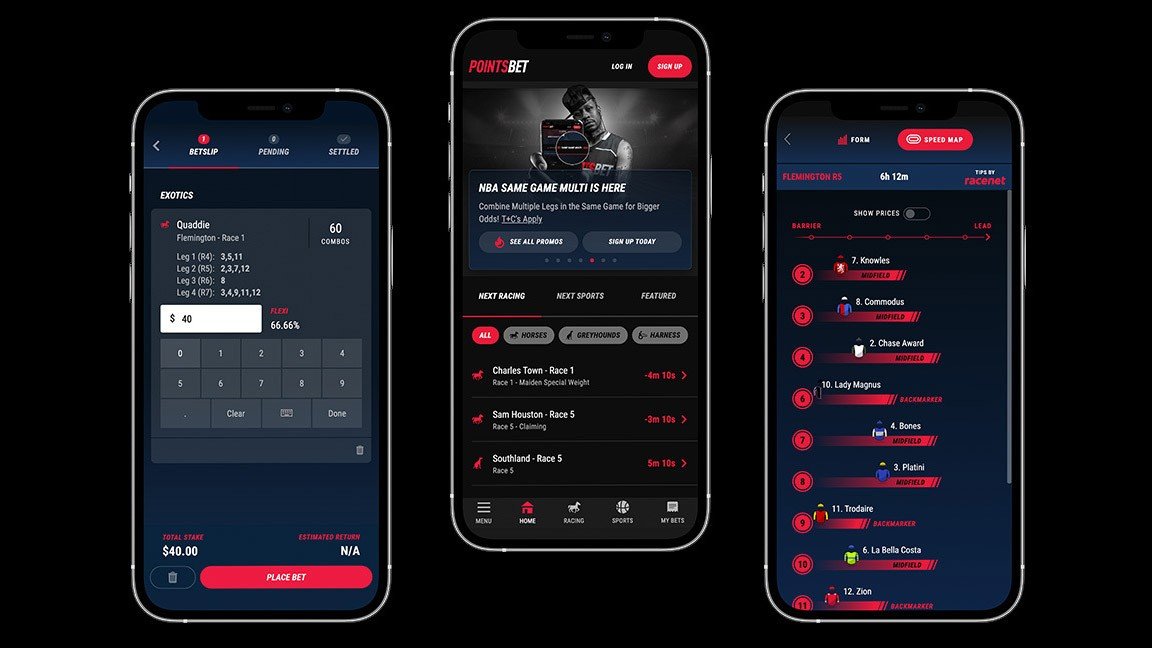

The deal helps solidify Fanatics as a mainstay in the sports betting market, having gathered massive assets in the app’s user experience and user interface departments while acquiring expert traders to help manage its risk in the new market.

Furthermore, the deal also gets Fanatics access to multiple keystone states for its app, including New York, New Jersey, Pennsylvania, Colorado, Illinois, Indiana, Kansas, Louisiana, Michigan, Virginia, and West Virginia. The apparel-turned-sports-betting company is already licensed and in beta testing in Massachusetts, Maryland, Ohio, and Tennessee.

Headquartered in Australia, PointsBet launched in the U.S. in 2019 and was one of the more aggressive sportsbooks in its first few years after closing a $500 million deal with NBC Sports and pioneering a partnership with the University of Colorado.

Its business has been flagged recently in the face of mounting competition and rising customer acquisition costs. The NBC deal was amended in February; the Colorado deal was terminated in March. This led PointsBet to hire investment bank Moelis & Company to seek a potential buyer in April.