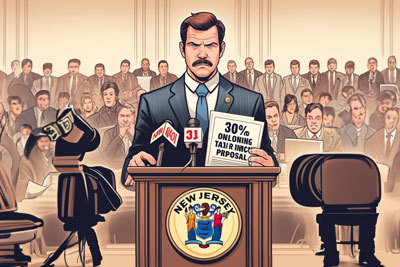

John McKeon, a senator in the State of New Jersey, has introduced a new bill which proposes a significant increase in the tax rate for online gambling and sports betting, bringing the figure to 30 percent.

The current tax rate for online gambling in New Jersey is 15 percent of gross gaming revenue, while the tax rate for sports betting is 13 percent of gross gaming revenue. The new bill, which bears the name of “Senate Bill 3064”, was filed two weeks ago and then formally introduced on 8 April. After that the bill was referred to the Senate State Government, Wagering, Tourism & Historic Preservation Committee.

The new bill basically amends two sections of the current legislation, Section 7 and Section 17, which stipulate the tax amount for sports wagering and online gambling, respectively. The proposal would take effect on the next 1 January that comes after the day of approval.

Still Lower Than Other States

The 30 percent tax rate would represent a drastic increase from the current rate in New Jersey, but it would still be lower than the tax rates established in other American states for online gambling and sports wagering.

New York for instance has a tax rate of 51 percent for sports betting, the highest in any competitive market in the United States. Pennsylvania comes in second place with a tax rate of 36 percent of gross gaming revenue.

States such as Delaware, New Hampshire and Rhode Island have tax rates above 50 percent of gross gaming revenue, but these states still run monopolies through state lotteries and don’t have competitive markets.

The current tax rate for online gambling in New Jersey is among the lowest in the country, with the state having 30 iGaming websites currently licensed and active on its competitive market. Connecticut has an 18 percent tax rate for online casinos, which is set to rise to 20 percent after five years, Michigan has a tax rate of 20 percent, while West Virginia takes 15 percent of gross gaming revenue from its online casinos.

The highest tax rate in the business remains the 54 percent imposed in Pennsylvania for slots, but that state seems to favor table games which have a tax rate of just 16 percent.

Ohio is an example of an American state that has recently increased its tax rate for online gambling and sports betting. In July 2023 Mike DeWine, the governor of Ohio, increased the tax rate from 10 percent to 20 percent.

Source: “New Jersey senator formally introduces bill to hike online tax to 30%“. iGaming Business. April 11, 2024.